"Our approach is not based on gimmicks or greenwashing but on truly realistic and future-proof actions."

Expertise

Our main focus is 'Integrated Sustainability Consultancy' in real estate. Many have different interpretations of what the definition of integrated sustainability, circularity and ESG should be or place a different emphasis on it. For us, it means delivering advice on the broad vision of integrated sustainability based on our international expertise, and at the same time offer our independent vision founded on detailed studies. Find out below how our expertise can be applied in function of the theme and which specific studies could apply to your project. All our services can be translated into project-specific guidance.

ESG Strategy

ESG Guidance and Reporting

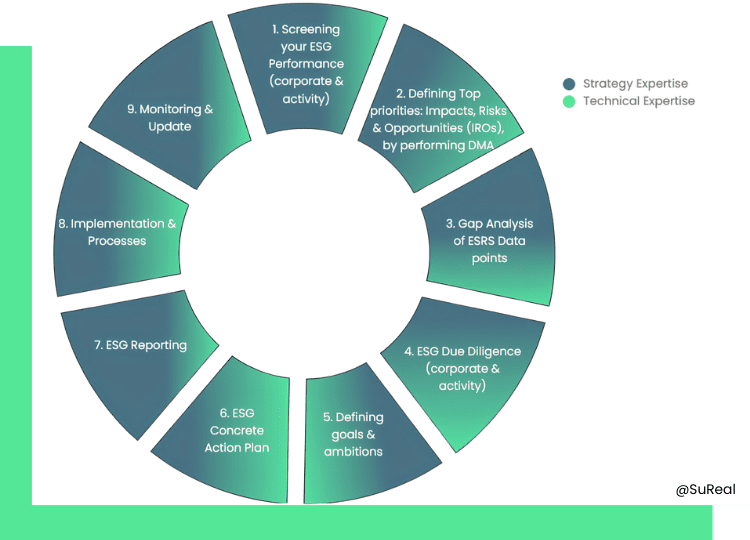

Sustainability begins with a well thought out sustainability strategy on company level. This strategy is unique for every company, and takes into account ambitions at corporate, portfolio and development level. The SuReal experts guide this process through interactive workshops and in-depth studies. The end goal is to have a clear sustainability strategy, translated into a framework, realistic but ambitious KPI’s and actions.

The SuReal experts take several steps with the client to come to this endresult:

Sustainability Framework (UN SDG’s, GRESB, GRI,…) Benchmarking company with other (inter)national peers Sustainability Due Diligence of existing projects Sustainability Due Diligence of development projects Sustainability Due Diligence of Company Materiality Matrix and stakeholder engagement Consolidation of the implantation plan GRESB check and/or certification Scorecards, in-house tools, program of demand, … Annual ESG Report (GRI, TCFD, CDP & CSRD) Thanks to the combined high-level approach of our business consultants and in-depth expertise of the engineering department, our guidance results in an ESG strategy that is holistic and detailed at the same time. As such, theory is translated into pragmatic action on the ground to ensure that sustainability is integrated throughout the organisation.

GRESB certification

The sustainability performance of a company is increasingly being considered as a main evaluation criteria by investors, banks and other financial institutions. To ensure consistency, ESG certifications for real estate have been developed.SuReal uses the GRESB framework to report on the ESG strategies and performances of its clients and to benchmark actions that are included in their Sustainability Roadmap.

GRESB is the global ESG benchmark for financial markets. The benchmark now covers $5.7 trillion of AuM (up from $4.8 trillion) and nearly 117,000 individual assets. The benchmark covers KPI’s on Corporate level, Portfolio level (existing assets) and Development level.

GRESB is also in line with SFDR, EU taxonomy, WELL and BREEAM making into a holistic approach. SuReal helps with the entire GRESB process.

The sustainability performance of a company is increasingly being considered as a main evaluation criteria by investors, banks and other financial institutions. To ensure consistency, ESG certifications for real estate have been developed.SuReal uses the GRESB framework to report on the ESG strategies and performances of its clients and to benchmark actions that are included in their Sustainability Roadmap.

GRESB is the global ESG benchmark for financial markets. The benchmark now covers $5.7 trillion of AuM (up from $4.8 trillion) and nearly 117,000 individual assets. The benchmark covers KPI’s on Corporate level, Portfolio level (existing assets) and Development level.

GRESB is also in line with SFDR, EU taxonomy, WELL and BREEAM making into a holistic approach. SuReal helps with the entire GRESB process.

Climate Risk Assesment

Are your assets future-proof?

How does it benefit you?

Assessing portfolio’s resilience to climate changes, developing an adaptation and mitigation plan, and integrating climate factors in their business choices.

How can SuReal help you?

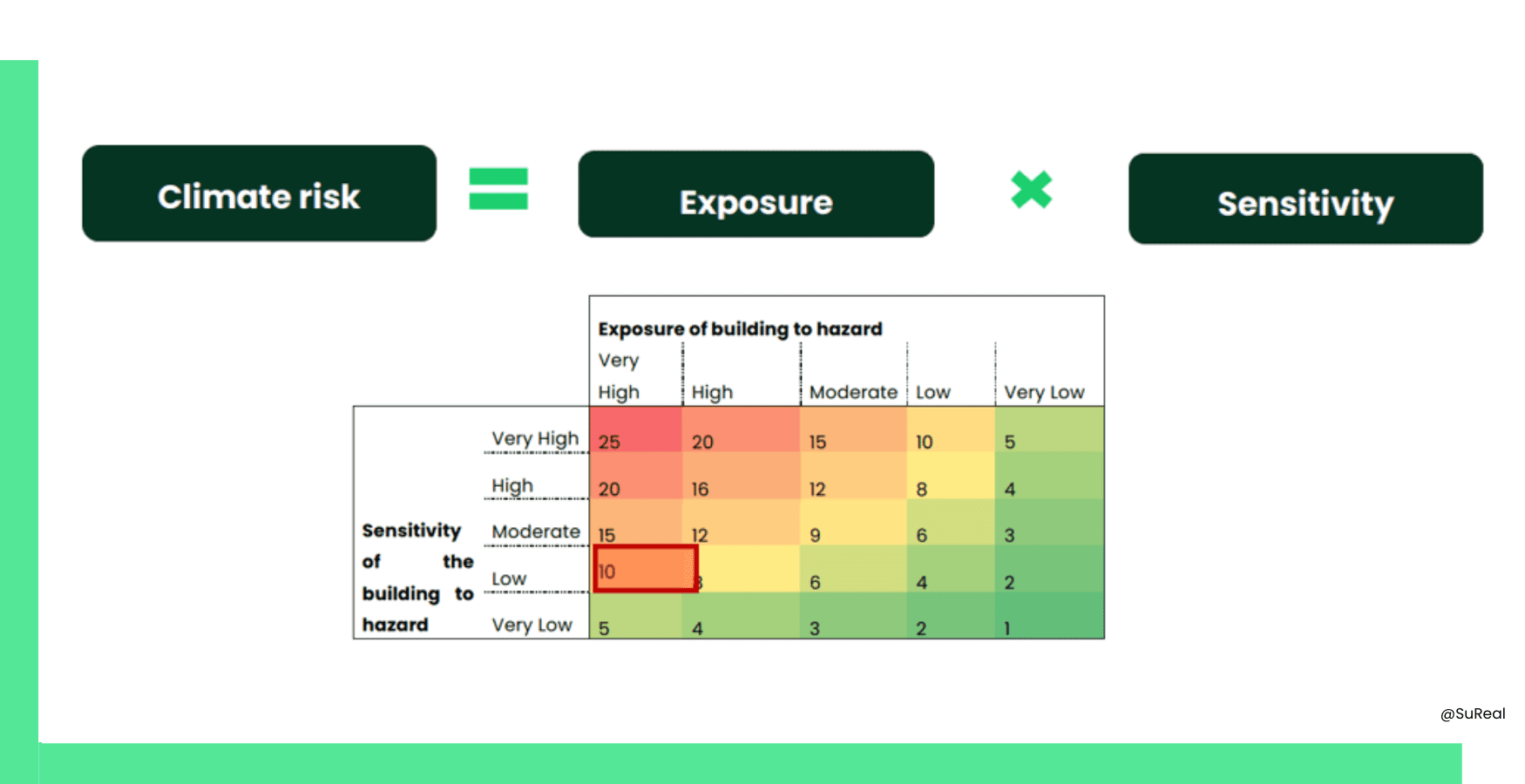

Physical risk assessment

We analyse assets and portfolios’ risk exposure to natural hazards as a result of climate change. Our approach aligns with IPCC scenarios and the Paris Agreement objectives. Can be used to provide evidence to the WST05 credit in BREEAM New Construction. (PARIS AGREEMENT ALIGNMENT)

Social risk assessment

We analyse the risks of exposure to social variables, such as accessibility, affordability and community impact, as a result of a continuously changing environment and society.

Transition risks with CCREM Analysis

We assess the transition risks exposure of your assets and portfolio, using CRREM based on its carbon budget and the decarbonization pathway to which the asset/portfolio is aligned to.

Resilience to climate change

We provide adaptation measures, whether in terms of general guidelines, or asset-specific to ensure the resilience of the asset in the long term. We support you with mitigation measures to comply with global emission reduction goals and avoid stranded assets.

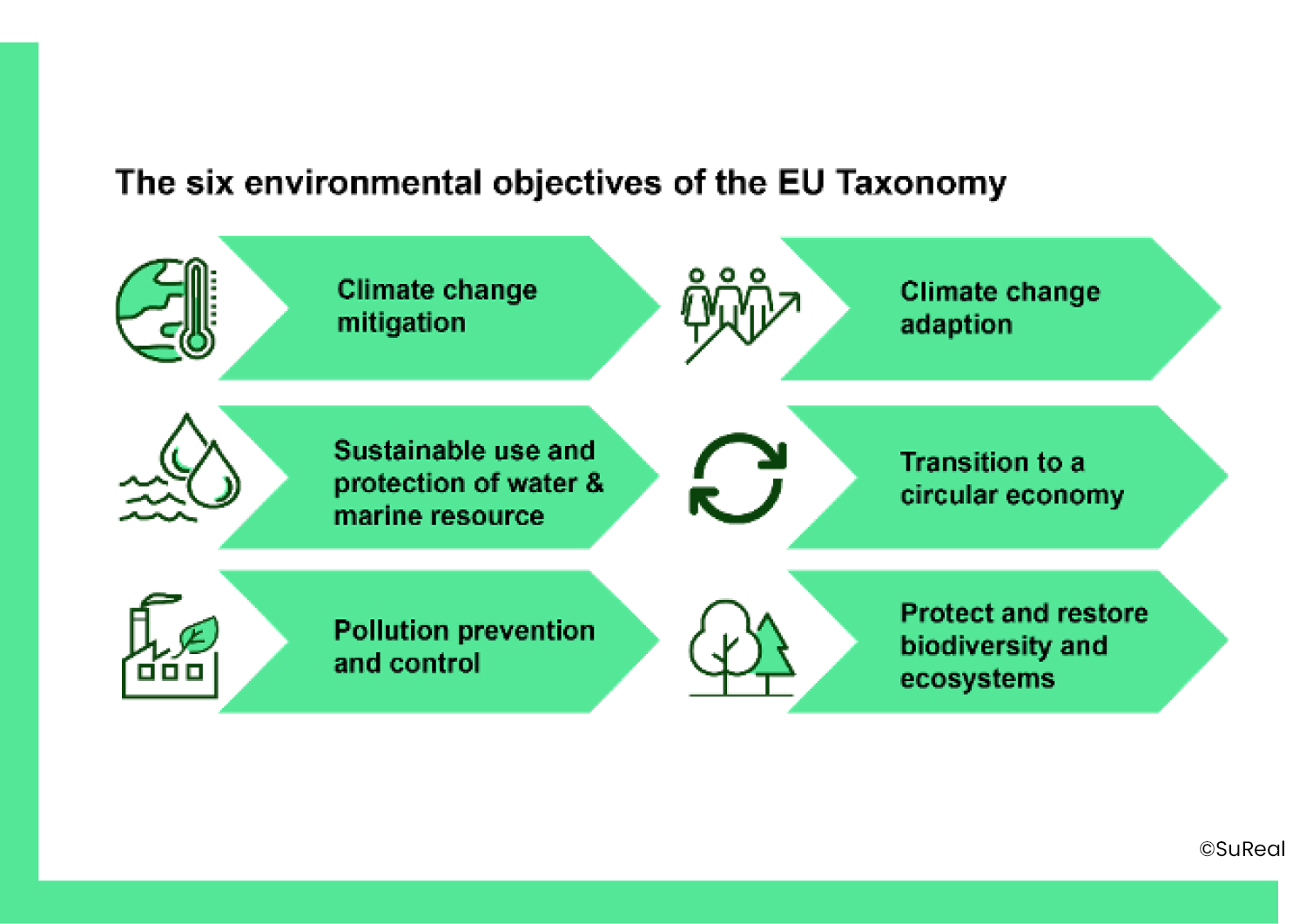

EU taxonomy

The EU Taxonomy is a leading science-based classification system expected to become the global standard for determining whether an economic activity can be considered environmentally sustainable.

The EU Taxonomy is rapidly evolving and can have a big impact on your company. SuReal supports companies to align their business activities and real estate assets with the technical screening criteria of the EU Taxonomy. Through the development of an EU Taxonomy alignment strategy, clear actions can be implemented both at company and asset level.

SuReal has extensive experience providing EU Taxonomy guidance:

EU Taxonomy due diligence EU Taxonomy stress test & full screening EU Taxonomy proofing – both at organisational and asset/portfolio level

CO2 Accounting & Decarbonisation

Where is your company in the CO2 emissions reduction journey?

The results

- Opportunities to reduce costs by optimizing energy consumption, reducing transportation or waste treatment costs and benefiting from States’ financial and tax incentives from the government.

- Gaining the confidence of investors as they are increasingly attentive to ESG performance

- Increased reputation with customers and stakeholders

How can SuReal help you?

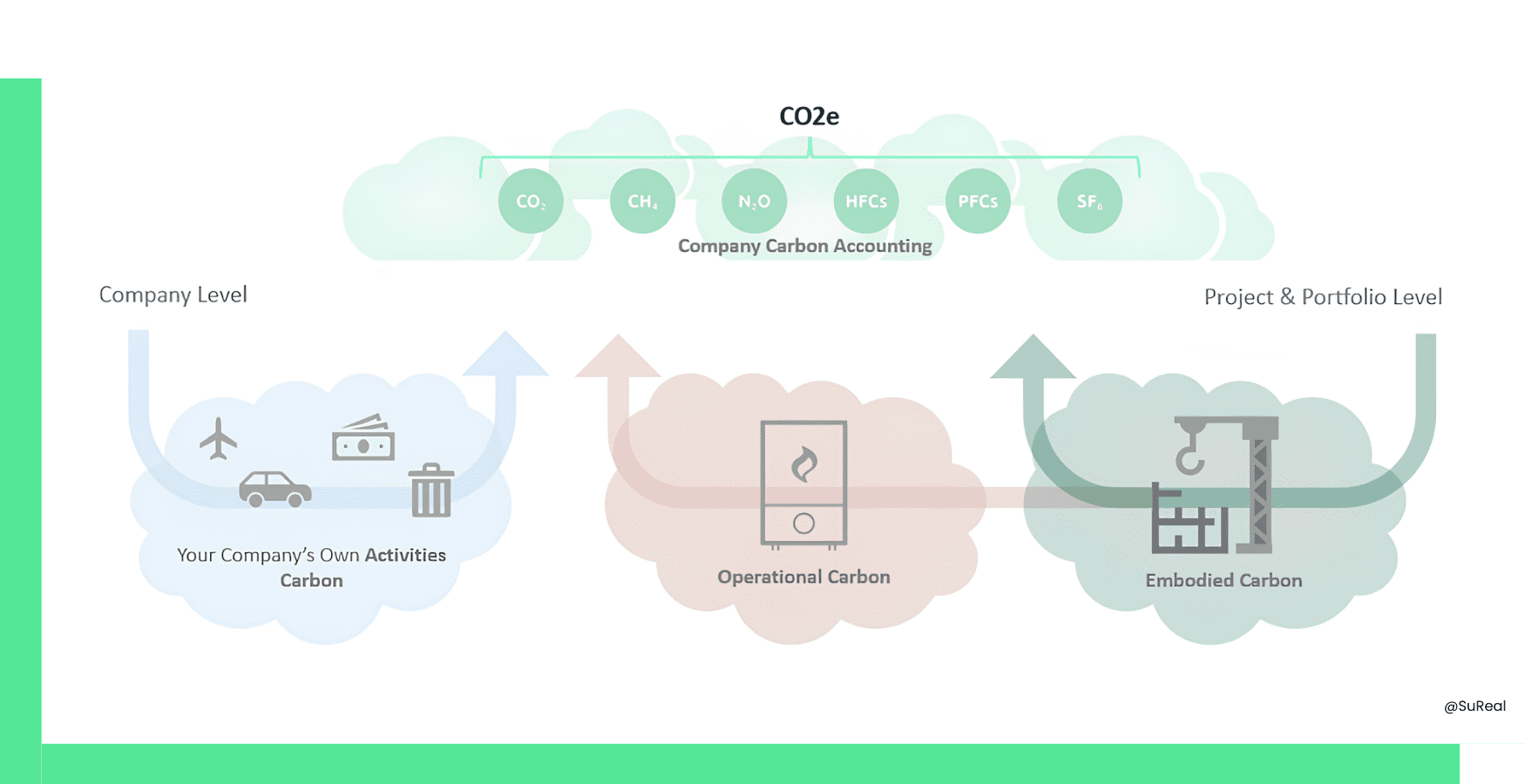

Measuring your CO2 footprint

At SuReal, we can support you in measuring your CO2 emissions and defining an effective decarbonisation plan for your assets and portfolio.

Understanding where your emission comes from:

- Scope 1: your direct emissions

- Scope 2: your indirect emissions, from offsite energy consumption

- Scope 3: the indirect emissions, coming from upstream and downstream activities

Decarbonising your assets/portfolio

We will provide you with high-quality analyses and action plans to achieve your carbon reduction targets.

The CRREM tool helps companies understand the performance of their portfolio’s carbon emissions, while it also allows them to evaluate transition risks and stranding risks. SuReal can support you in running the CRREM analysis, highlighting strategic axes for building decarbonisation and implementing long-term solutions for maintaining the value of your assets.

CSRD

Who must report under the CSRD?

CSRD, what is it? “New EU legislation requiring all large companies to publish regular reports on their environmental and social impact activities”

Investors, Developers, Constructors, etc.

Companies already subject to NFRD

- 500+ employees

- Reporting under NFRD

Reporting in 2025 on year 2024

Large undertakings currently not subjected to NFRD

- 250+ employees

- 50 mln+ net turnover

- 25 mln+ net assets

Reporting in 2026 on year 2025

Listed SMEs, small and non-complex institutions and captive insurance undertakings

- > 50 employees (small, medium)

- > 10 mln net turnover

- > 5 mln net asset

Reporting in 2027 on year 2026

Thermal comfort guidance and simulations

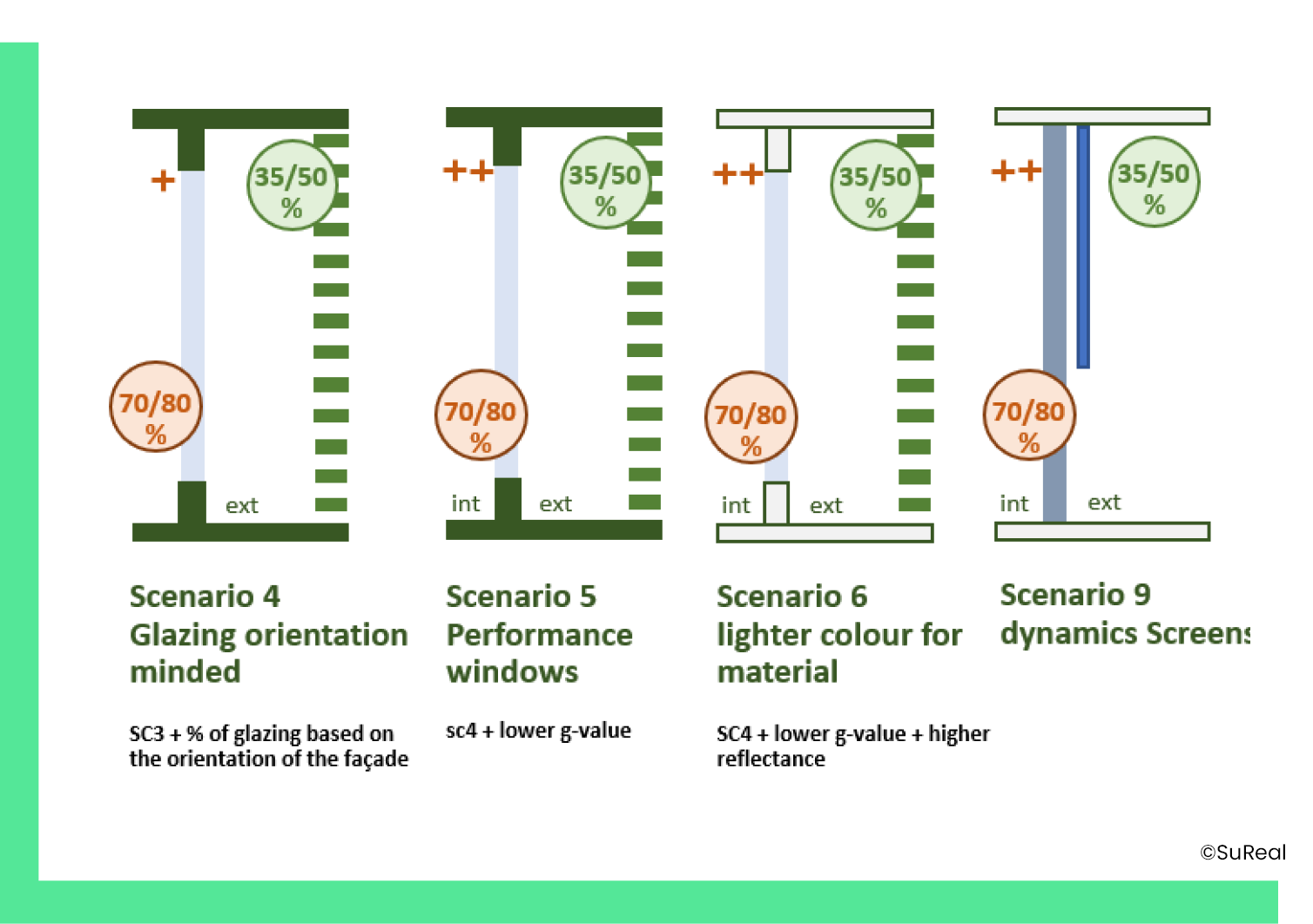

Verification of discomfort is done through dynamic simulations where realistic input parameters are considered, such as future climate data incorporating urban heat island effects, emission powers of systems present in the analysed rooms, different types of building envelopes, etc.

This approach enables us to determine in an early design stage which technical solution is most optimal from a techno-financial perspective. It verifies if active cooling is a necessity or if passive techniques are sufficient, it analyses the feasibility of different glazing typologies and/or innovative shading elements, etc.

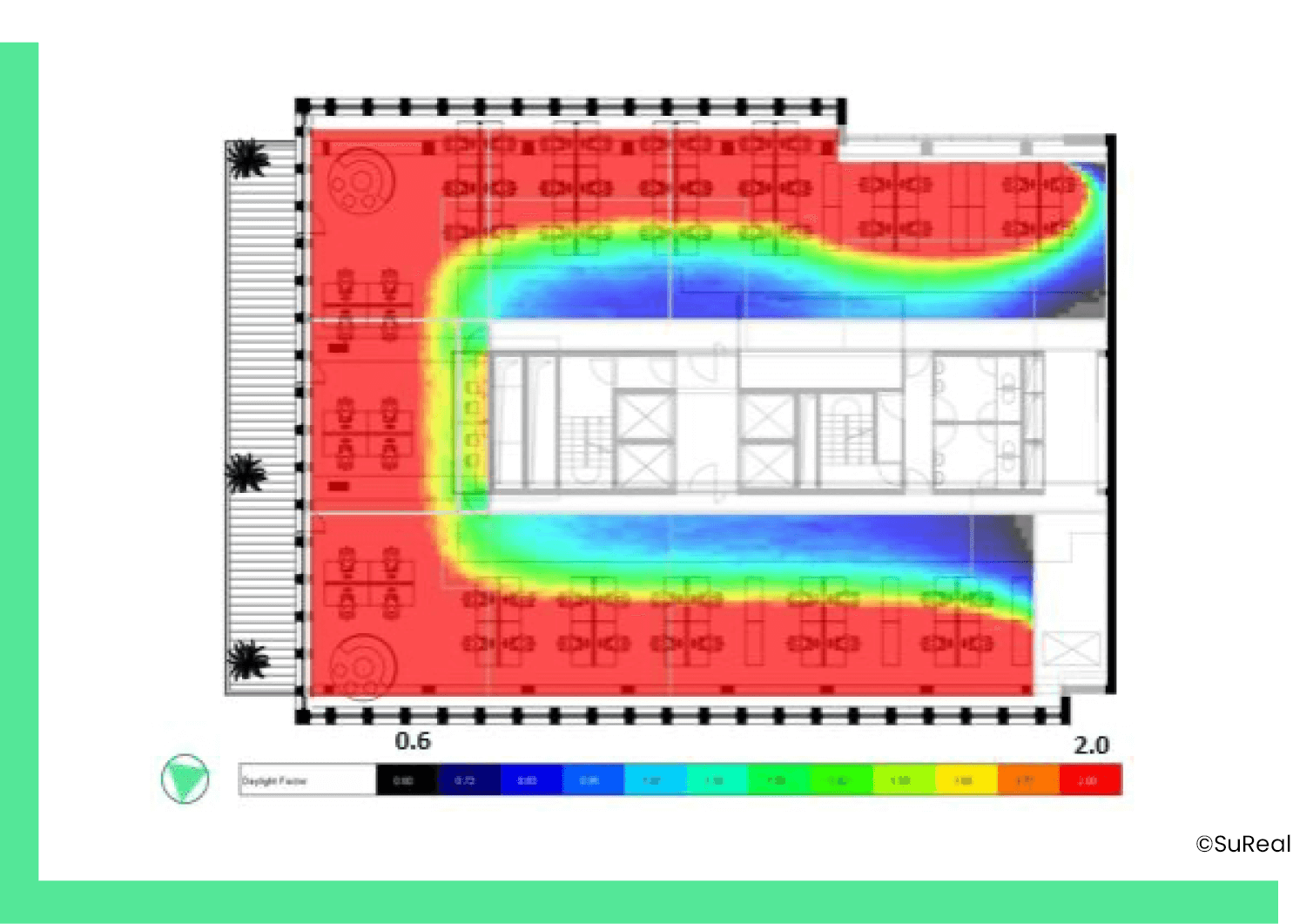

Visual comfort and guidance simulations

Day- and sunlight is analysed based on full-year models, considering shading elements and transmission characteristics of glazing, allowing to evaluate daylight autonomy, glare, sun exposure, and much more.

These insights are analysed according to visual comfort standards, while considering the related impacts on thermal comfort, cooling performance, artificial lighting consumption and levels of well-being.

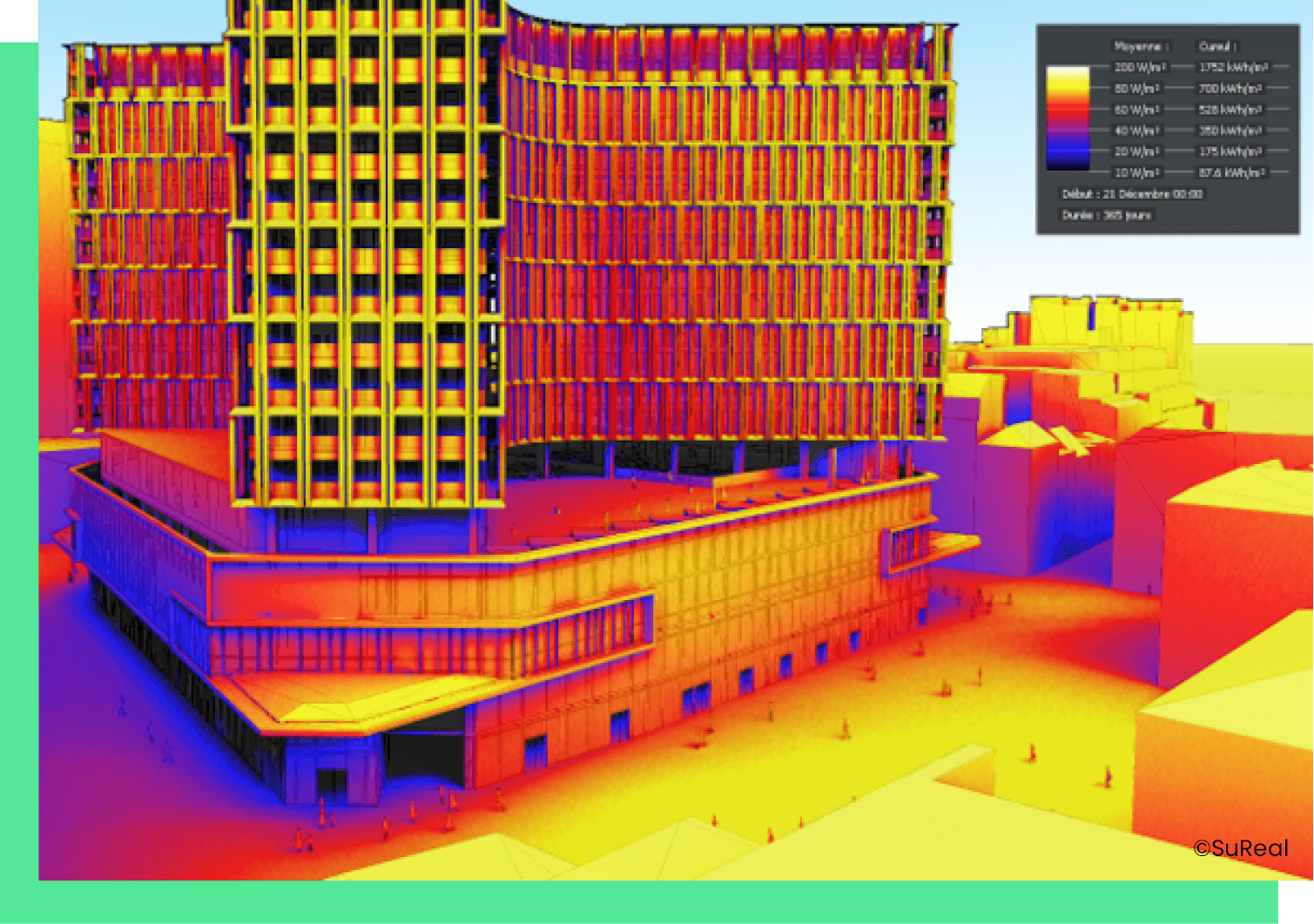

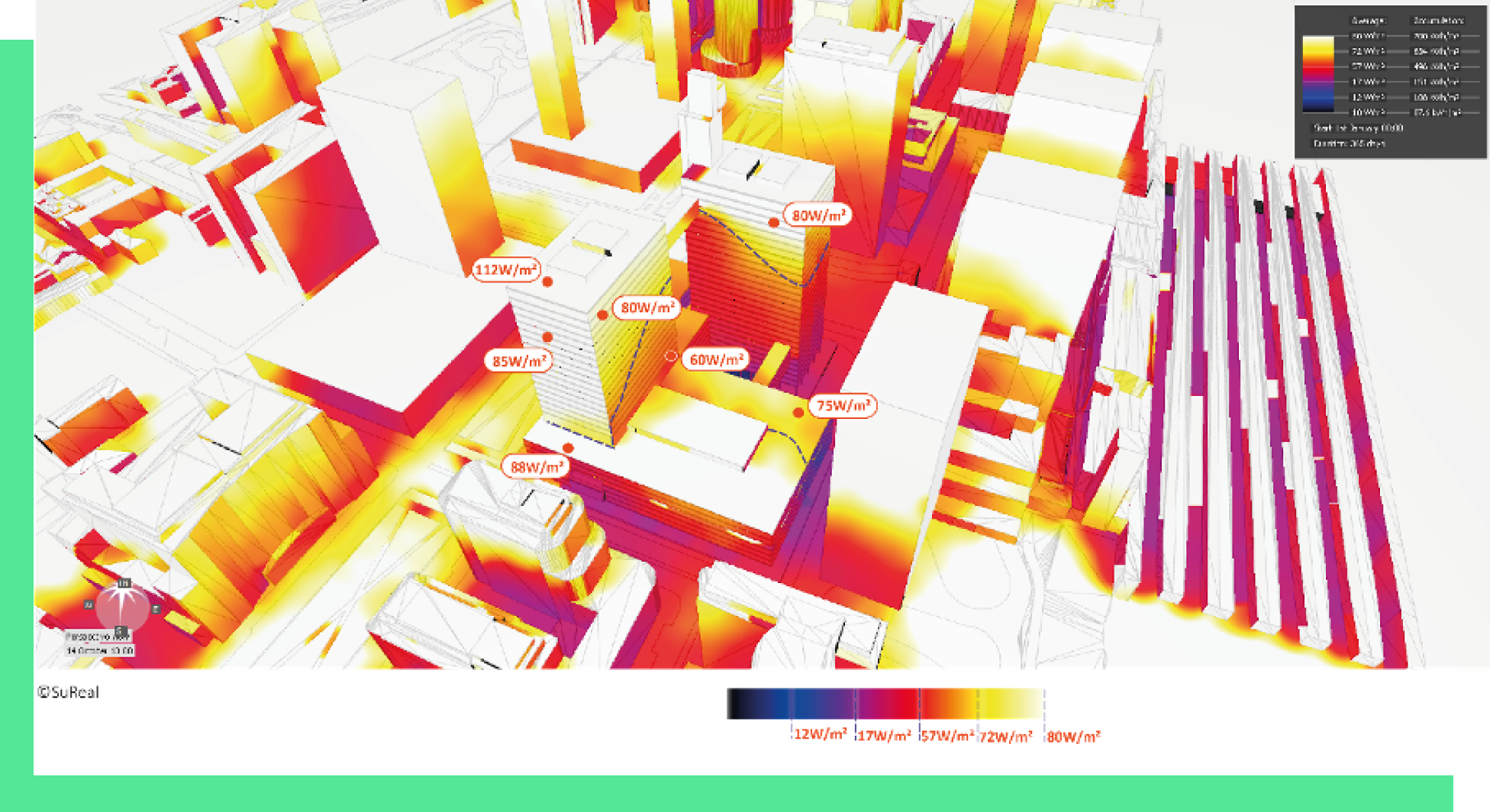

Irradiation optimization and simulations

The direct and indirect solar irradiation is simulated for the current and the projected situation. This allows us to identify the total amount of sun hours at every moment of the year (on squares, balconies, neighbouring buildings, PV-arrays, …), which enables us to propose optimization measures at masterplan level.

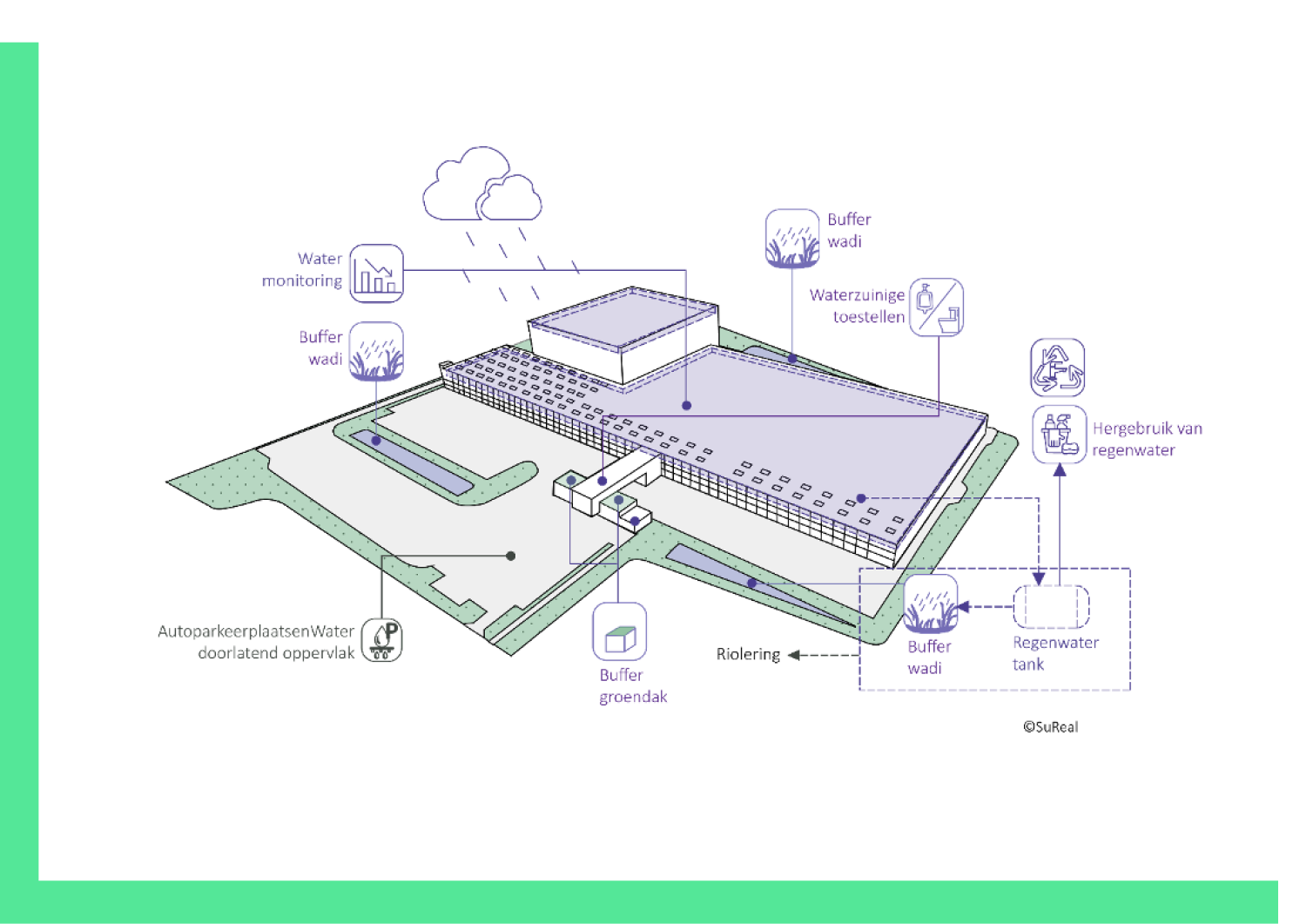

Water concept studies

Permeable and impermeable materials, the intensity of land-use, the ecological value of a site, buffering and infiltration of water, biodiversity, … all go hand in hand. We use the studies below to feed our vision and to arrive at concrete propositions:

Ecology reports: after analyzing the current ecological value we propose a set of coherent measures to improve the site ecology. Water run-off calculations: to size buffering and infiltration in an optimal way we determine the water run-off from a site. Climate change adaptation and mitigation: considering the prospected impacts due to climate change we screen projects to maximize risk mitigation.

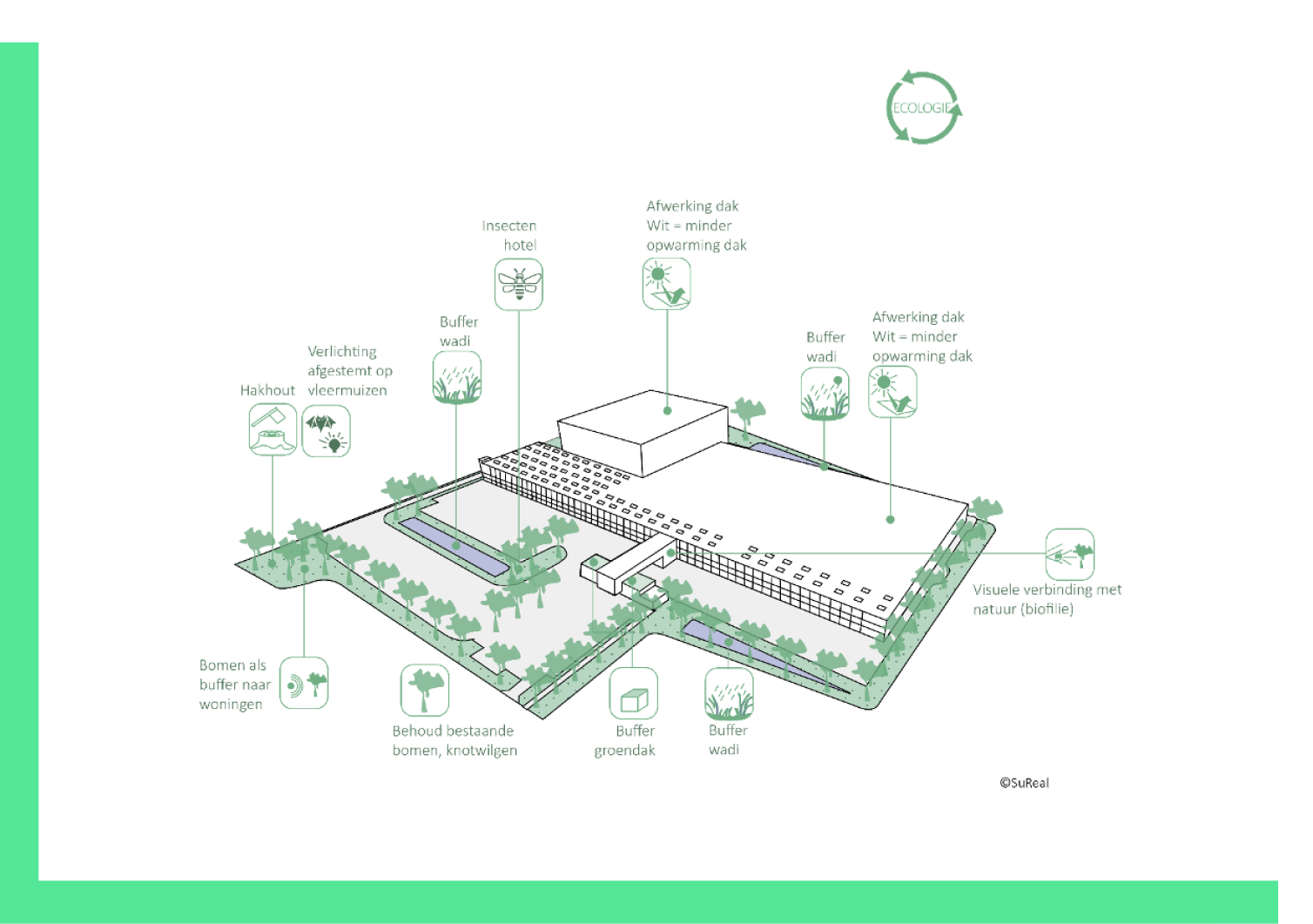

Ecology guidance and reports

Biodiversity, resiliency and ecology of our landscaping architecture of the building also defines the overall sustainability of the building project. However small the building plot, an ecology strategy should be set forth.

A qualified ecologist from SuReal performs an ecology report of the project (also BREEAM conform), a resiliency strategy is performed and other social and ecological aspects are aligned to the project.

Hygrothermal analysis

As we are confronted with an extensive uninsulated building stock, renovation is of the essence to minimize our footprint. On top of that, in order to preserve historical valuable architecture, exterior insulation isn’t always an option.

This induces the need for interior insulation, which is known to be able to cause frost damage, condensation, etc. Therefore, intelligent insulation methods are required to avoid unwanted hygrothermal effects. Our hygrothermal simulations help to take the optimal design decisions regarding interior insulation.

Wind comfort and simulations

On a building level, we analyse the tenants' comfort in outdoor spaces such as balconies, rooftops, or private gardens. We can also simulate the behaviour of the wind on the façades to look for potential wind induced noises or other unwanted effects. During concept design stage, we investigate the wind conditions around the building and we propose some interventions on the external shape to optimize the usage of external spaces around and on the building, either by reducing wind effects or sometimes by inducing them to avoid the heat island effect.

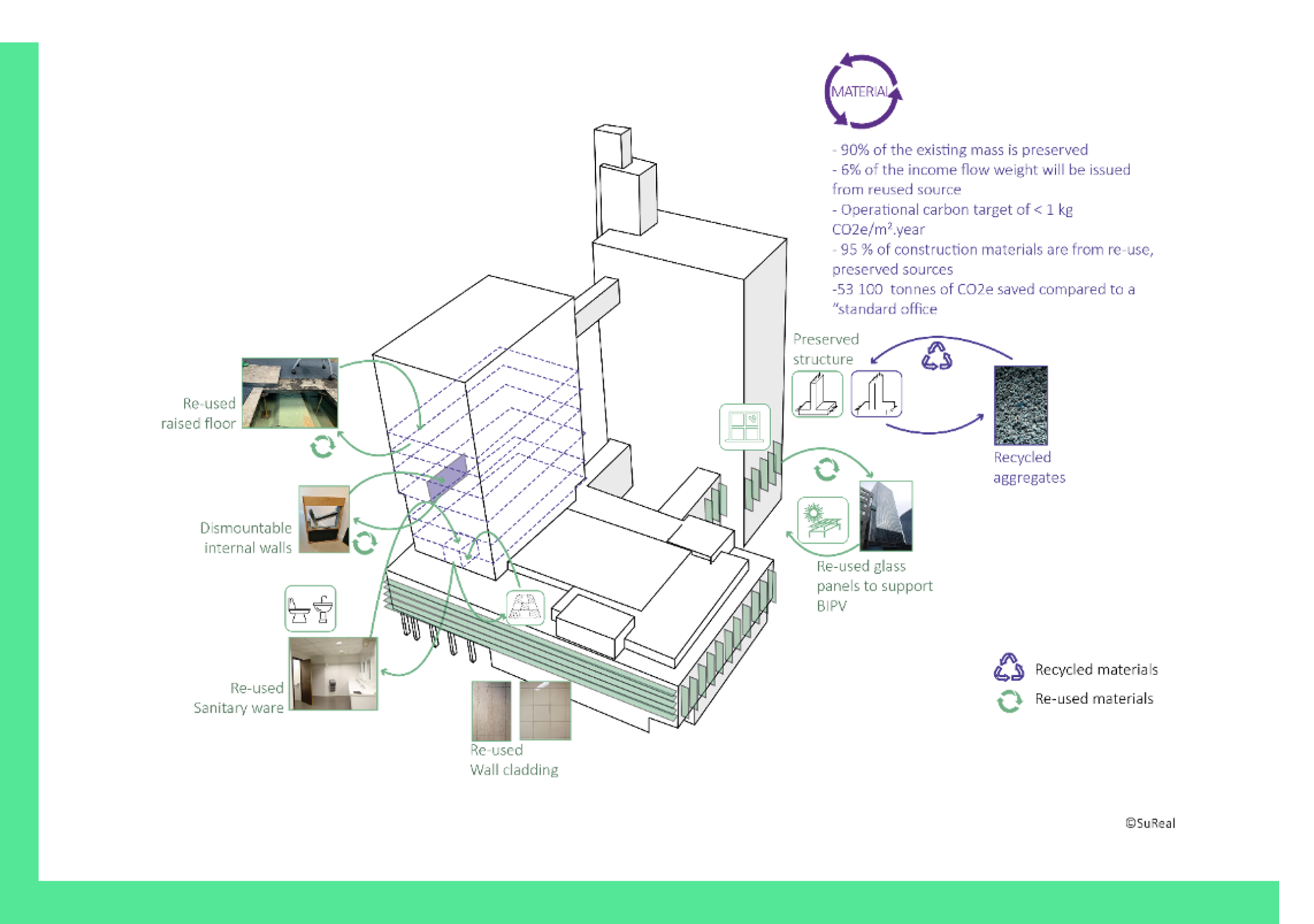

Circular Economy concept and guidance

Circular Economy is a regenerative model where resources are not thrown away after use but are continuously used instead, at high intrinsic value through reuse, repair, repurpose, upcycling, recycling, etc. In contrast to the linear economic model where natural resources are extracted from earth, turned into products, and ultimately discarded, the circular economy approach focuses on resource conservation and waste minimization through strategies like designing out of waste, keeping products and materials in use, and actively improving the environment through regenerative natural systems. (Ellen Macarthur Foundation).

The approach of SuReal in this regard is Refuse, Reduce, Re-use. The experts of SuReal have a vast experience with:

Building Inventory: making an inventory of all the materials in the existing building, their environmental impact, their potential for re-use and expected life span.

Multi-Criteria analysis of circular solutions (environmental impact, life cycle impact, potential for re-use, urban mining potential, impact on acoustiscs, thermal, visual, hyhgrothermal , cost,… elements. Thanks to the integration of a multi-criteria analysis circular economy is not isolated and has the potential to exceed.

Building Passport: making an inventory of all the materials in the new building, their environmental impact, their potential for re-use and expected life span.

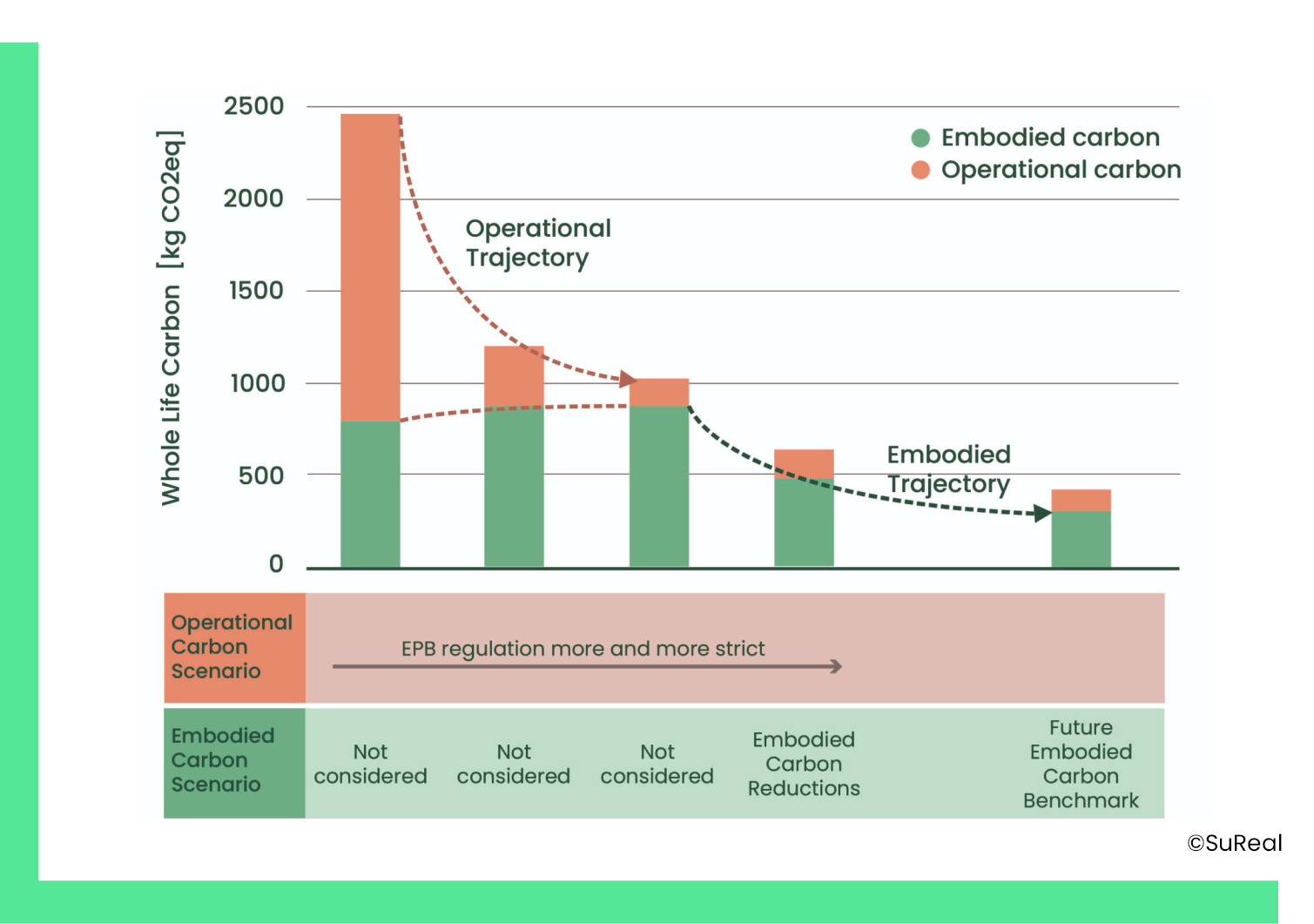

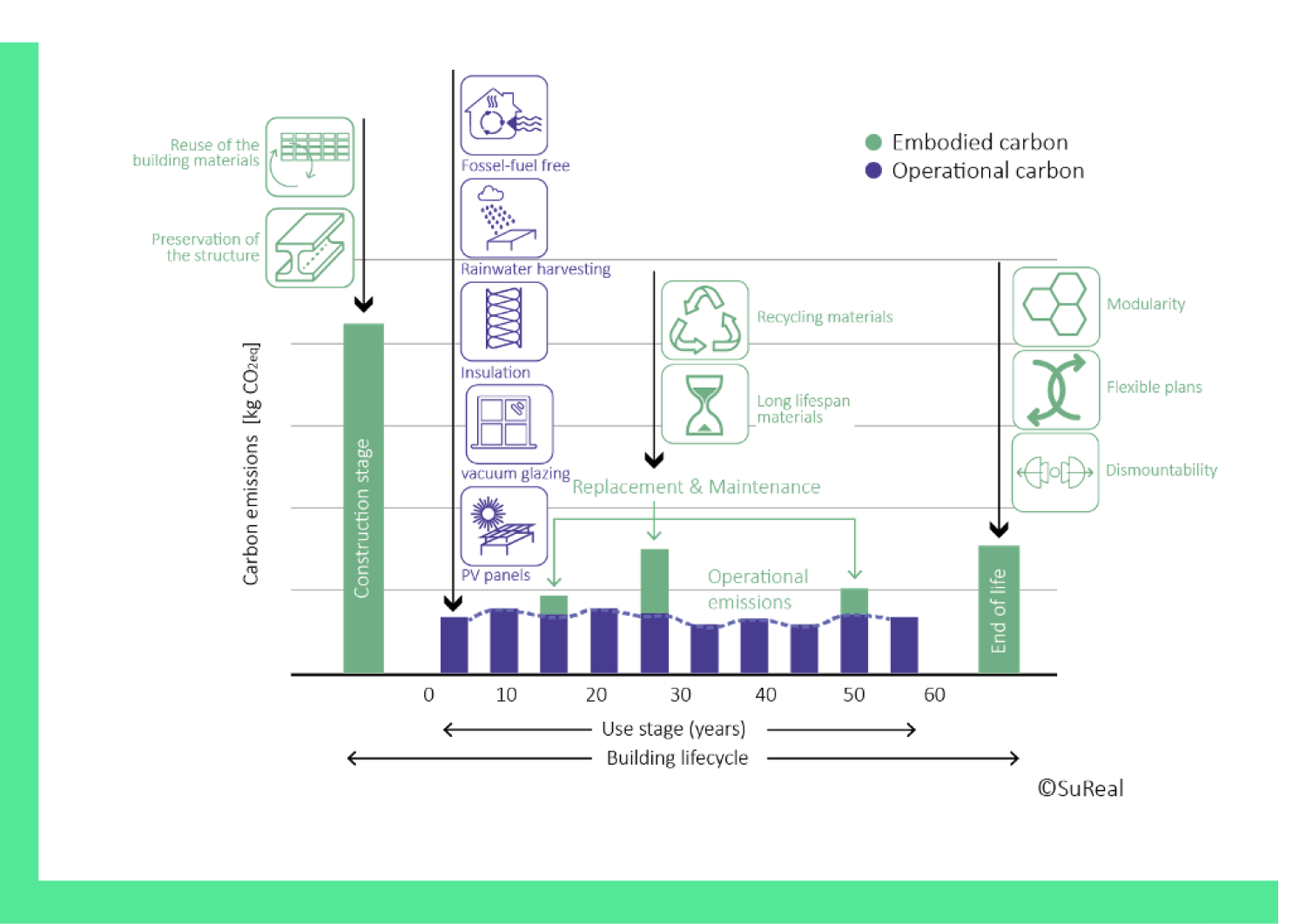

Life Cycle Assessments

In order to make well-founded design choices (ex. new construction versus renovation) as well as material choices (ex. concrete or wood as structural material) we offer detailed Life Cycle Assessments (LCA). The total environmental cost is simulated and calculated for all building elements (from extraction until end of life).

We offer the following methodologies for LCA:

One Click LCA (BREEAM conform study) TOTEM Simapro

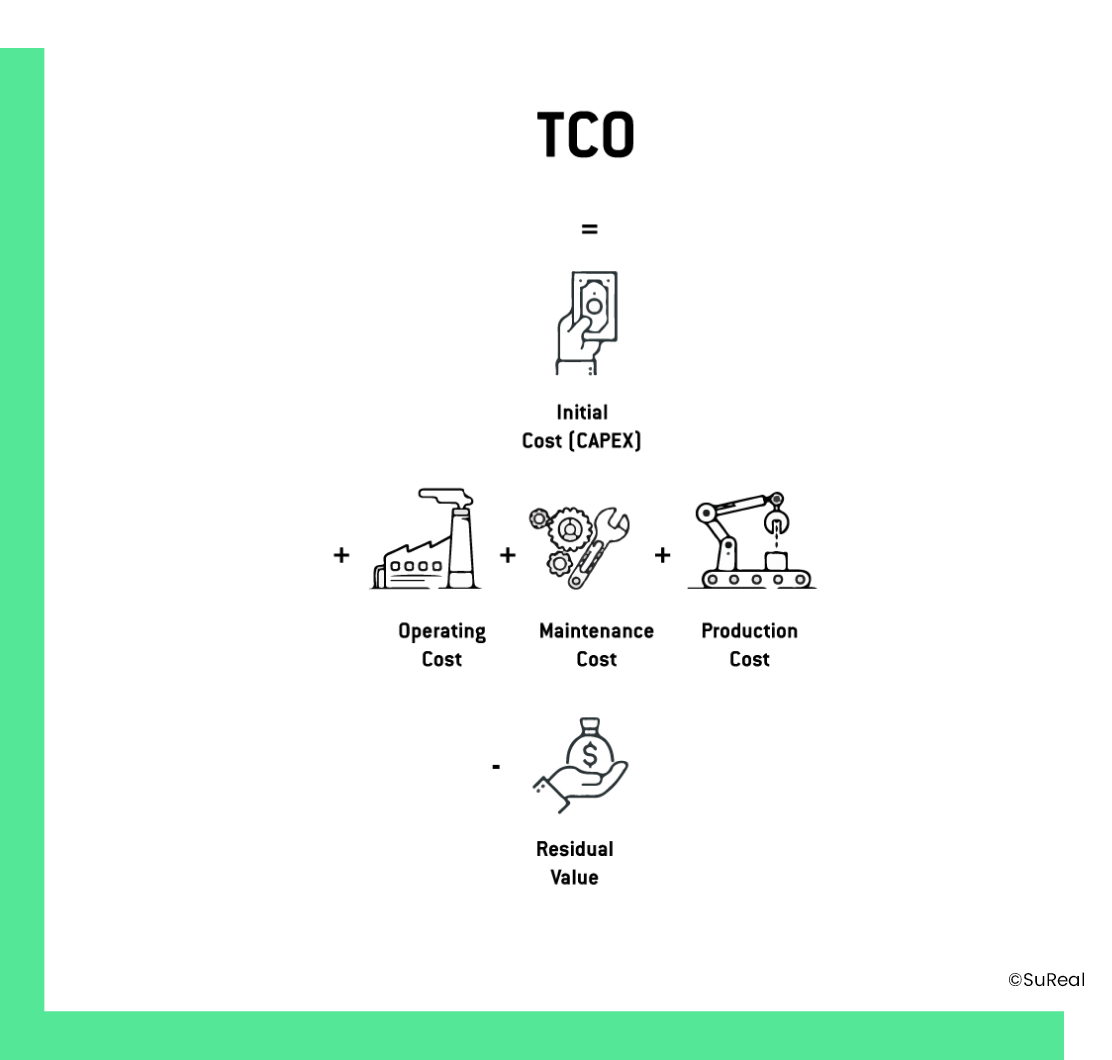

Life Cycle Cost Assessments

The CAPEX (investment costs), OPEX (operational costs; replacement, repair, …) of certain solutions are calculated over the life span of a building for several solutions. It is used as a decision tool for technical, material, stability solutions.

Total Cost of Ownership of energy concepts

A sustainable project must also be economically feasible. The feasibility aspect is project-specific. For a lighthouse project, investment costs might be accepted to be higher. For social housing projects, however, affordability is key. The beauty lies in finding the right balance between ecology and economy. That economic balance should also be examined in different ways: CAPEX (Investment costs) variations, TCO (Total Cost of Ownership) variations, total values, evaluation period, price changes, etc.

Already from an early stage, the economic feasibility can be analysed, even as of site selection. Through the design and building process, the hypotheses can be defined more in detail and the feasibility studies more accurately.

These studies can be on masterplan level (achieving a CO2-neutral site at what price?), building level (which low carbon initiatives, passive skin,…), or elemental level (charging points, …).

Our technical-feasibility studies are always custom-made, input and output details can be tuned to your specific needs. The method is also applicable for BREEAM LCC-studies.

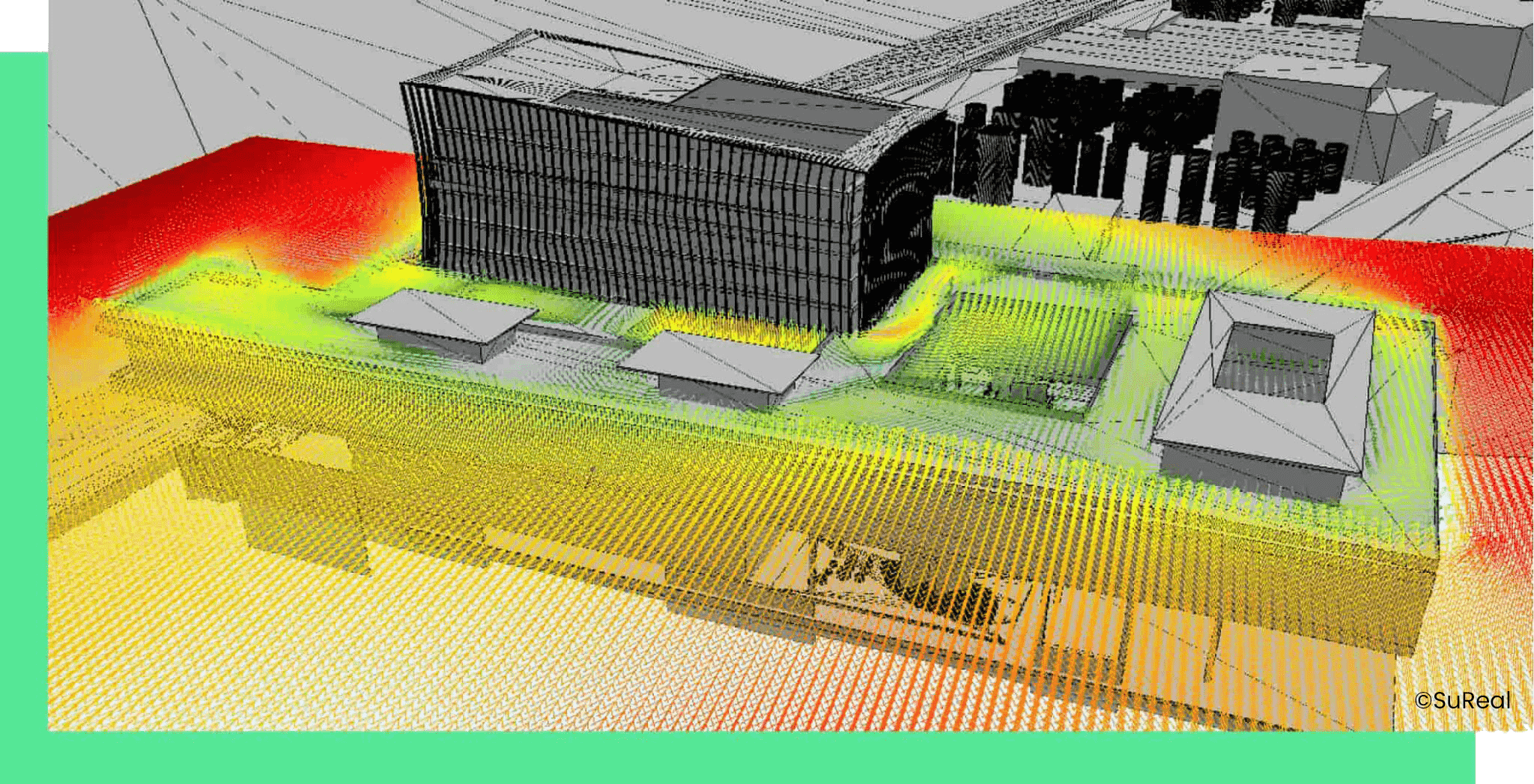

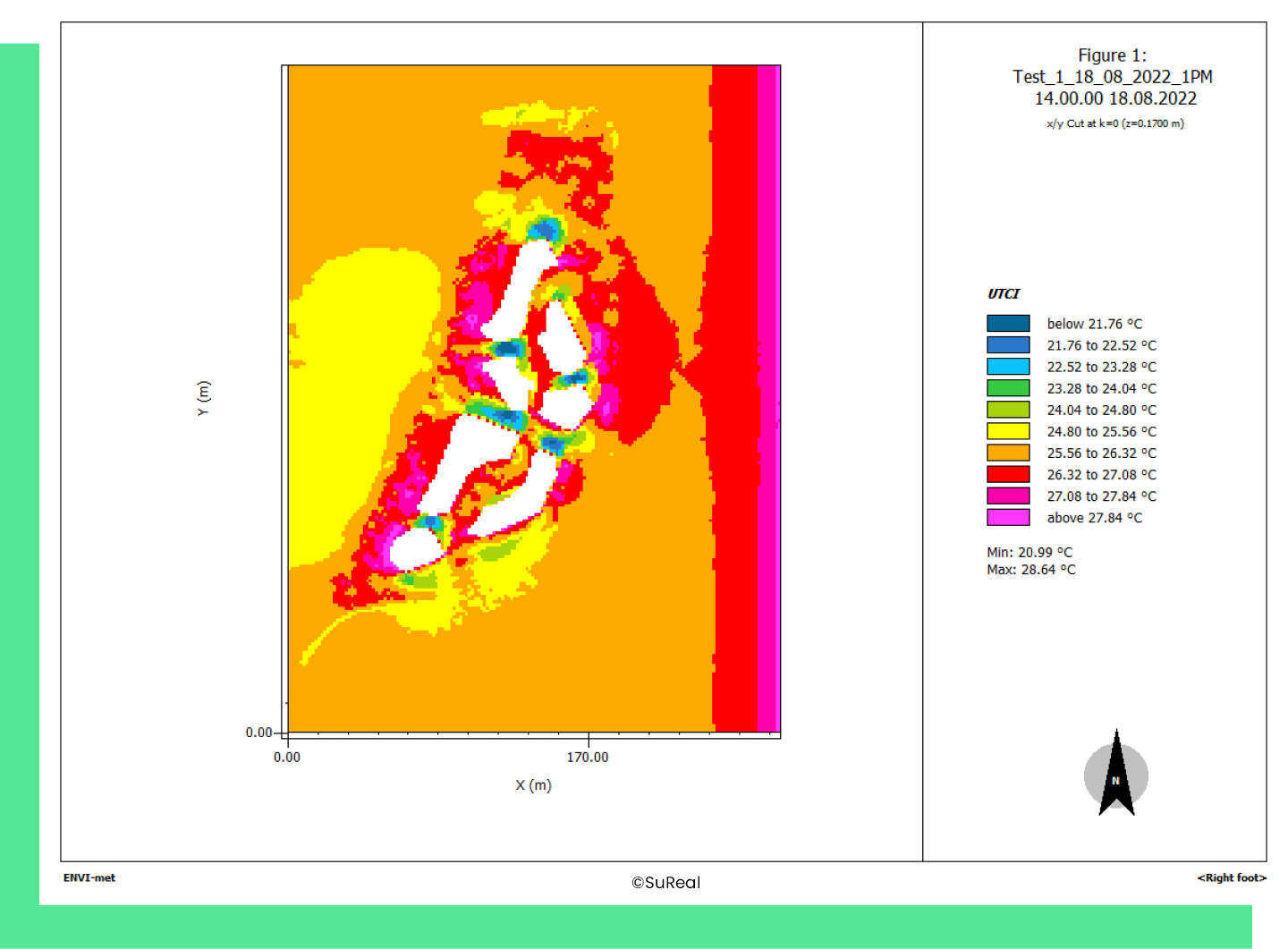

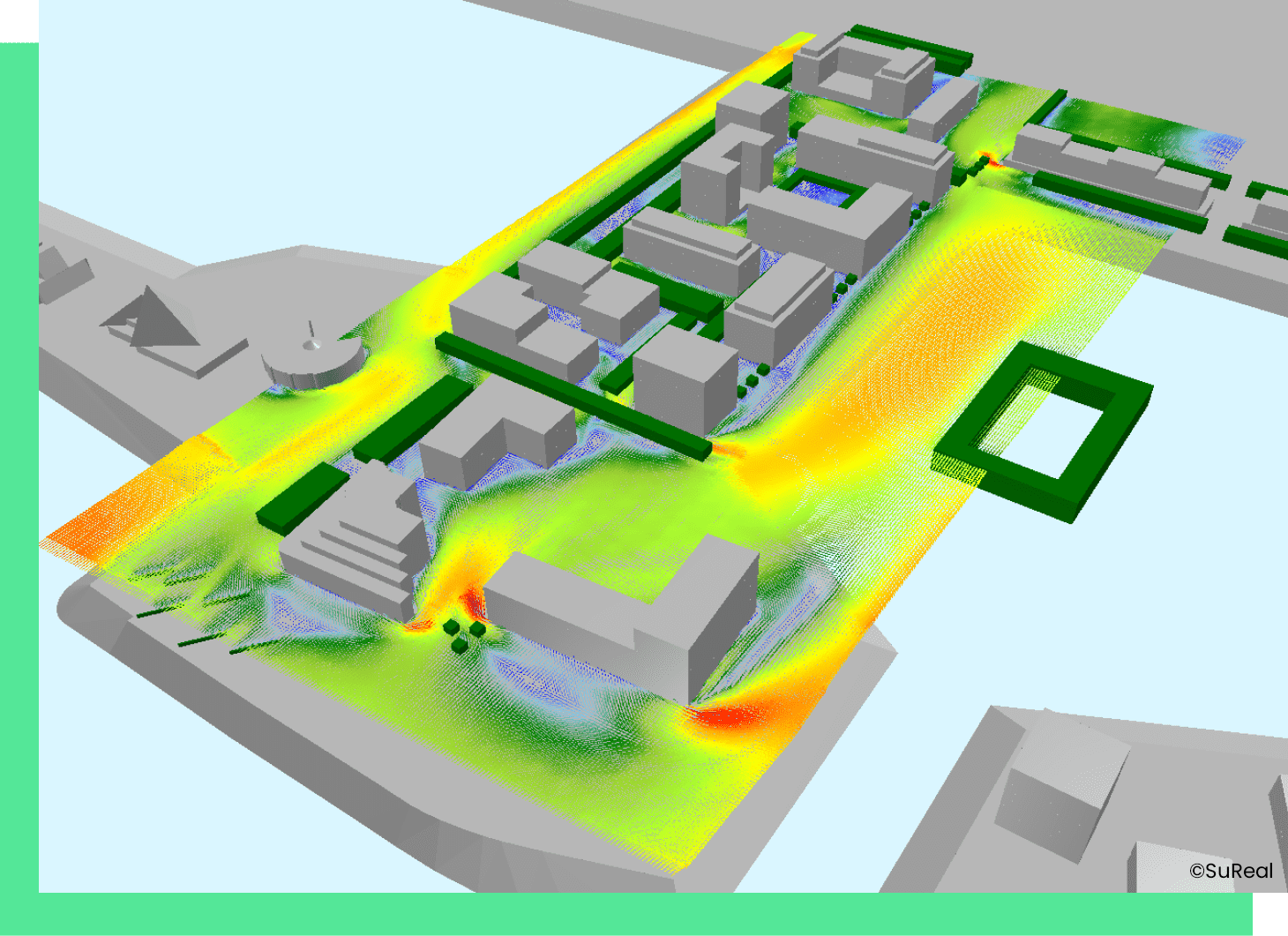

Heat island effect and simulations

Verification of discomfort is done through dynamic simulations where realistic input parameters are considered, such as future climate data incorporating urban heat island effects, emission powers of systems present in the analysed rooms, different types of building envelopes, etc. This approach enables us to determine in an early design stage which technical solution is most optimal from a technical-economical perspective. It verifies if active cooling is a necessity or if passive techniques are sufficient, it analyses the feasibility of different glazing typologies and/or innovative shading elements, etc.

Wind comfort simulations (CFD)

Wind is difficult to grasp. In an urbanized environment, its behaviour becomes more complex in contact with buildings, and many effects can occur: speed-ups (Venturi effect), vortices, plunging flows, interference, detachments, etc. The built environment thus creates a microclimate that can cause discomfort for users. To achieve sustainable architecture and urban planning, it is essential to study these aerodynamic phenomena and to integrate them as early as possible in masterplans. Through Computational Fluid Dynamics (CFD) software the urban microclimate is simulated with regard to wind comfort of pedestrians. On a masterplan level, minor interventions on volumetry or landscaping can be sufficient to drastically improve outdoor comfort.

Irradiation optimization and simulations

The direct and indirect solar irradiation is simulated for the current and the projected situation. This allows us to identify the total amount of sun hours at every moment of the year (on squares, balconies, neighbouring buildings, PV-arrays, …), which enables us to propose optimization measures on masterplan level.

Water

Permeable and impermeable materials, the intensity of land-use, the ecological value of a site, buffering and infiltration of water, biodiversity, … all go hand in hand. We use the studies below to feed our vision and to come to concrete propositions:• Ecology reports: after analyzing the current ecological value we propose a set of coherent measures to improve the site ecology.• Water run-off calculations: to size buffering and infiltration in an optimal way we determine the water run-off from a site.• Climate change adaptation and mitigation: considering the prospected impacts due to climate change we screen projects to maximize risk mitigation.

BREEAM

BREEAM, the international sustainability assessment method developed by BRE, is worldwide the most recognized method of assessing, rating and certifying the sustainability of buildings.

As BREEAM AP (Accredited Professional) and BREEAM Assessor we help define the most appropriate rating by performing a detailed cost-benefit analysis for each credit. We guide the team in achieving this score and we can perform most of the required studies.

As BREEAM Assessor we are accredited for:

BREEAM Communities BREEAM New Construction BREEAM RFO (Refurbishment and Fit-out) BREEAM In-Use

WELL

WELL is the leading tool for advancing health and well-being in buildings globally.

Where BREEAM assesses the overall sustainability of the building, WELL certification assesses the impact of the building and operational aspects on human health and wellbeing. WELL was developed by integrating scientific and medical research and literature on environmental health, behavioral factors, health outcomes and demographic risk factors that affect health with leading practices in building design, construction and management.

SuReal is your partner for WELL pre-assessments, “WELL proofed” design consultancy and full WELL certifications.

At SuReal we use the values of WELL not only for certification purposes but to enhance all of our projects.

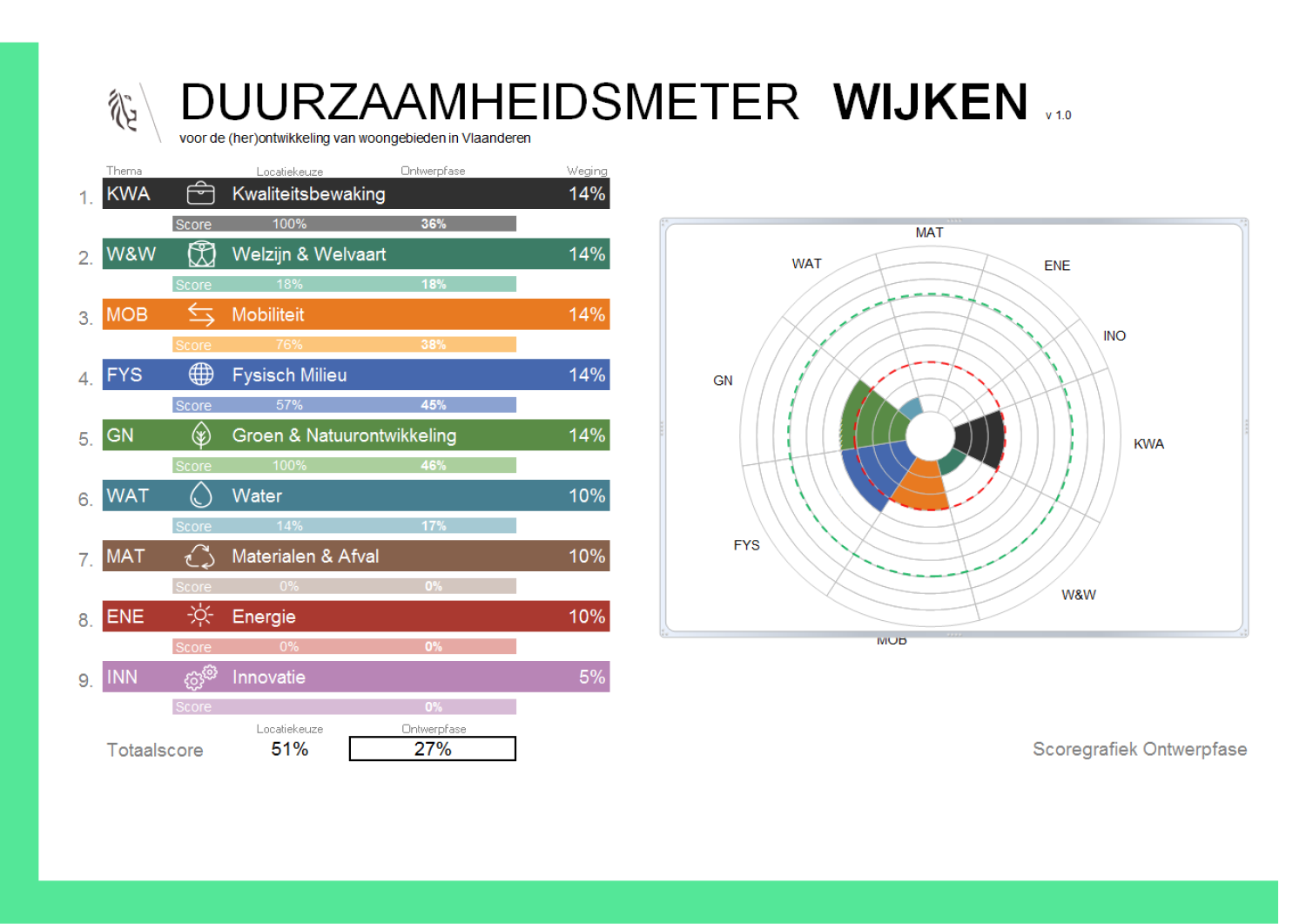

Duurzaamheidsmeter wijken / scholen / industriële sites

Duurzaamheidsmeter wijken, scholen and industriële sites are sustainability frameworks made by the Flemish government. They offer a holistic and pragmatic guideline to designing schools, neighboorhoods and industrial sites.

The same approach as with BREEAM is used: an interactive process with the team and pro-active guidance towards the design team, the clients and the governing body.

A final rating and level is obtained but also in depth advice is given for all sustainability aspects.

GRO

GRO is a sustainability and circular economy framework for office buildings made by the Flemish government. It offers a holistic and pragmatic guideline to designing in a sustainable and circular way.

The same approach as with BREEAM is used: an interactive process with the team and pro-active guidance towards the design team, the clients and the governing body.

A final rating and level is obtained but also in depth advice is given for all sustainability aspects.

LEED

LEED, or Leadership in Energy and Environmental Design, is a globally recognized program that certifies buildings for their sustainability. It assesses factors like energy efficiency, water use, and materials to promote environmentally responsible construction. Achieving LEED certification demonstrates a commitment to eco-friendly building practices, leading to lower operational costs and a reduced environmental footprint. It's a valuable tool for creating high-performance, sustainable structures.

DGNB

DGNB is the German certification to building construction. In terms of content, the DGNB System is based on three key paradigms that set it apart from other certification systems available on the market:

Life cycle assessment Holistic Performance orientation The same approach as with BREEAM is used: an interactive process with the team and pro-active guidance towards the design team, the clients and the governing body.

A final rating and level is obtained but also in depth advice is given for all sustainability aspects.

EPB/PEB

EPB/PEB informs the potential buyer or tenant about the property’s energy performance.

To avoid the EPB-tool would only serve as an administrative ‘to do’, we use this certification scheme in a pro-active way and in combination with other tools (TCO, comfort simulations,…). During conceptual and technical phases we will seek the most cost-efficient solutions with regard to the envelope, HVAC and renewable energy technologies together with the client in order to meet the ambitions.

Our experts also have extensive knowledge on the integration of innovative concepts in the EPB-software, inducing the fact that we don’t fear to innovate when needed.

We can take on the responsibility of EPB advisor for:

Flanders Brussels Region Wallonia

Custom made sustainability tools

Where no existing tool fits the specific characteristics or needs of the project, we provide custom-made tools based on our experience and on existing sustainability assessment tools. The same approach as with BREEAM is used: an interactive process with the team and pro-active guidance towards the design team, the clients and the governing body.

EDGE

The EDGE (Excellence in Design for Greater Efficiencies) certification is a comprehensive sustainability assessment method for buildings. It meticulously analyses energy consumption, water usage, and the CO2 impact of construction materials in your project. To achieve EDGE certification, your building must surpass a locally estimated baseline, derived from macro data, by at least 20% in all three categories. EDGE offers clear objectives and targets, a straightforward certification process, it focuses on core evidence, and provides substantial optimization opportunities. A pre-certification is performed during detailed design, after verification in post construction, the final certification is delivered.